Helping Clients prepare Effective and Personalized Estate Plans and Trusts You Need to Protect Your Legacy. Let us show you how we can protect your Assets utilizing Trusts, Insurance solutions and Tax Strategies.

At Covenant Estate Planning LLC, our Attorney’s, Insurance brokers, Trust and Tax professionals provide exceptional estate planning services to clients nationwide. We assist clients with a wide range of estate planning with primary expertise that include establishing:

919-230-0700

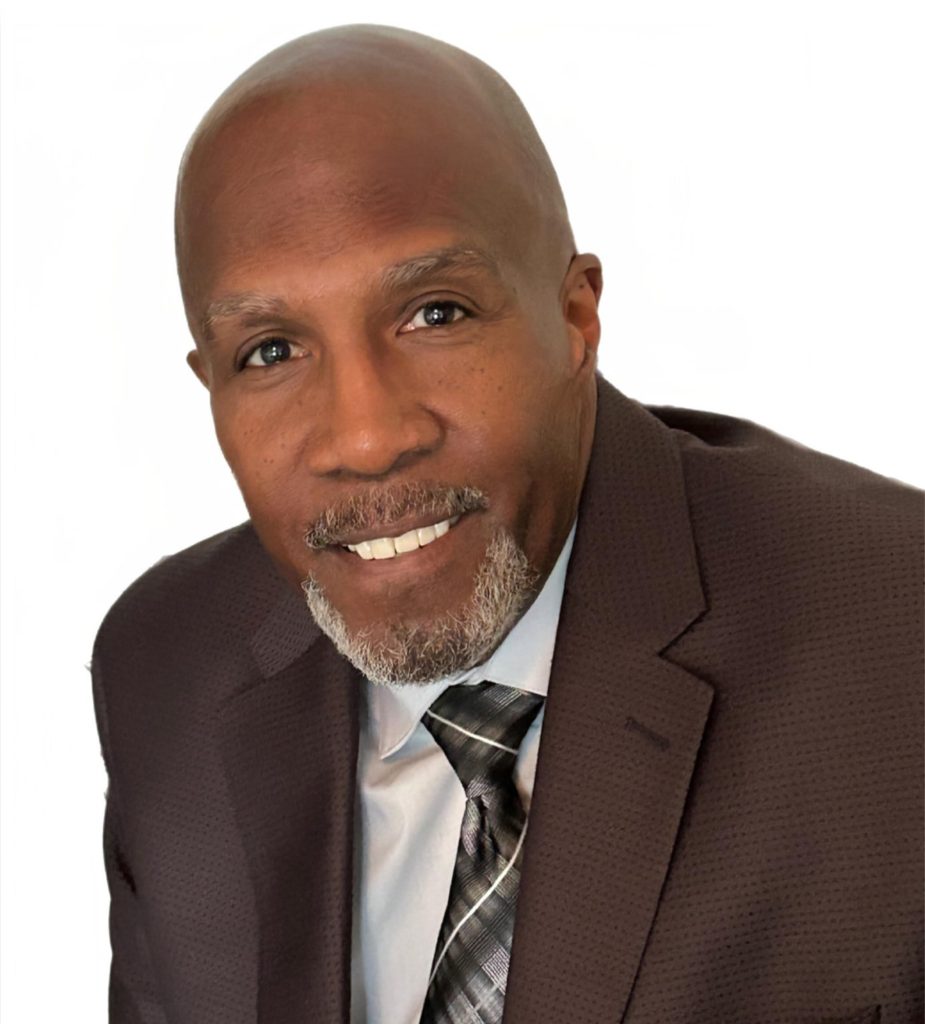

Dr. Lester Shelley is the Co-Founder of the Elise Financial Group who’s Licensed Insurance Agents serve clients nationwide. Shelley is a founder and managing partner of Covenant Estate Planning LLC which has a mission to provide personalized, reliable guidance in helping clients with estate planning and establishing Common Law Trust.

Dr. Shelley is a founder, managing partner and Sr. Vice President of the MARK IV Development Group a Real Estate Development and Investment Company based in Raleigh, NC. A US Army Veteran with over 17 years of service, Shelley is medically retired from the US Army and retired from the NJ Department of Military and Veteran Affairs where he served as a Chaplain.

Dr. Shelley is an Ordained Minister and has a (B.S.) from Philadelphia Biblical University, a Master of Divinity from New Brunswick Theological Seminary and a Earned Doctor of Ministry from Regent Divinity School.

Michael Taplin is a Licensed Insurance Broker and Infinite Banking Specialist. Michael is the founder of Taplin Financial a firm built on a foundation of “Service Before Self” and unwavering values of Excellence and Integrity with over fifteen years in the Insurance Industry. Michael is a founder and managing partner of Covenant Estate Planning LLC and he has a mission to provide personalized, reliable guidance in helping clients with estate planning and establishing Trust.

A retired US Air Force Officer with over 24 years of service, Michael’s leadership has positioned Covenant Estate Planning for unpresented success in serving clients nationwide. Michael is a graduate of Golden Gate University with a B.S. in Human Relations and a Master of Science and Administration from Central Michigan University.

Clifford Williams, a born leader helped his mother expand a successful contracting business in the suburbs of Washington, DC employing hundreds of people for over a decade. While helping his mother Clifford began a healing ministry where he traveled the globe and broadcast to millions on network TV. Cliff is a former Prime Minister of a Tribal Nation and has built a burgeoning private banking practice leveraging the relationships he has developed with leaders around the world.

An expert in Estate Planning, and establishing Common Law Trust, Cliff has created private associations of successful entrepreneurs, investors that focus on high level finance and real estate development. Clifford Williams attended Lee University.

Kellee Baker, Esq, owned a Real Estate Brokerage and licensed in DC, MD, VA, & FL has over 20 years of experience in real estate development and law. Kellee is an exceptional leader that takes pride in assisting clients with investments, estate planning and establishing Common Law Trust.

Kellee earned a B.S. in Marketing from the University of MD College Park, and a J.D. from Howard University School of Law. Kellee and Clifford manage the BLAQK Family Office Group, a multi-family office (MFO) that serves as support for multiple families’ investments, governance, and philanthropy planning.

Lorem ipsum dolor sit amet consectetur. Ut quis amet eget at facilisis et lorem faucibus. Commodo eget id ut pharetra. Accumsan sagittis urna mi pellentesque placerat egestas. Amet amet magna euismod sem.

Lorem ipsum dolor sit amet consectetur. Ut quis amet eget at facilisis et lorem faucibus. Commodo eget id ut pharetra. Accumsan sagittis urna mi pellentesque placerat egestas. Amet amet magna euismod sem.

Lorem ipsum dolor sit amet consectetur. Ut quis amet eget at facilisis et lorem faucibus. Commodo eget id ut pharetra. Accumsan sagittis urna mi pellentesque placerat egestas. Amet amet magna euismod sem.

Lorem ipsum dolor sit amet consectetur. Ut quis amet eget at facilisis et lorem faucibus. Commodo eget id ut pharetra. Accumsan sagittis urna mi pellentesque placerat egestas. Amet amet magna euismod sem.

We assist clients in crafting personalized and effective estate plans to protect their assets and loved ones. Our approach ensures their wishes are clearly documented and legally secure.

A Living Trust is a personal entity that you put your assets into. Like a personal

LLC that you put everything you own in. Except it doesn’t protect you from

liability like an LLC, it protects your assets and heirs from probate.

Probate is the court facilitated legal process that takes place if you don’t have a

defensible living trust in place at the time of death. This process can take anywhere

from 9 to 18 months and cost you up to 10% to the total value of your estate in

court fees and attorney costs.

To create a trust, you will:

1. Go through Covenant Estate Planning intake process in person or online to

gather your details and generate the type of trust you desire and that benefits

your needs.

2. After you review your trust and are satisfied we schedule a time with one of

our notaries in person or online to sign and notarize your trust. Remote

notary legislation currently exists in many state and includes many changes

enacted during the COVID-19 pandemic due to social distancing

requirements. This allows Covenant Estate Planning to take advantage of

state specific notary laws to ensure that your trust can be legally and fully

remotely notarized in all 50 state.

Here are the differences:

Ø A Will is a document that describes who you want to inherit your assets after you die. After you die, your Will is interpreted by a judge during a public process known as probate.

On average probate court takes 12-18 months and can be very expensive with court and attorney fees. If family and friends challenge the will or distribution of assets the process can be longer which will add more attorney fees.

Ø A Trust is a personal entity that allows the trustee or owner the option of putting assets into the trust. With a Trust your able to assign who you want to inherit your assets and it also allows you to assign someone to manage the Trust, (The Trustee.)

With a Trust you can completely circumvent probate and make transferring your assets private. If you think of it like an LLC that you put everything you own into. Except it doesn’t protect you from liability like an LLC, it protects your heirs from probate and your successor trustee takes control of the Trust and distributes your assets based on your instructions. Your Successor Trustee can be a trusted individual like a close family member or friend.

Our Moto is “Integrity and Trust” and everyone should have a Trust, not just the 1% of Americans that have Trust.

Contact Covenant Estate Planning and Our Representatives Can Answer Any Questions You Have and Walk You Through The Process of Establishing Your Trust.Helping Clients Prepare Effective and Personalized Estate Plans and Trust You Need to Protect Your Legacy.

©2025 Covenant Estate Planning LLC / All Rights Reserved

Enhance your business protection and management with our tailored business trusts. Enjoy benefits like liability protection and efficient asset management, allowing you to focus on what you do best: running your business